-

Research suggests that to comply with the MiCA regulation and its Travel Rule, crypto platforms are introducing new requirements for withdrawals and deposits, focusing on verifying user and wallet information.

-

It seems likely that users will need to verify ownership of self-hosted wallets for transactions over €1,000 and provide recipient details for withdrawals to other platforms.

-

The evidence leans toward these changes enhancing security and transparency, though they may feel intrusive to some users concerned about privacy.

What Are MiCA and the Travel Rule?

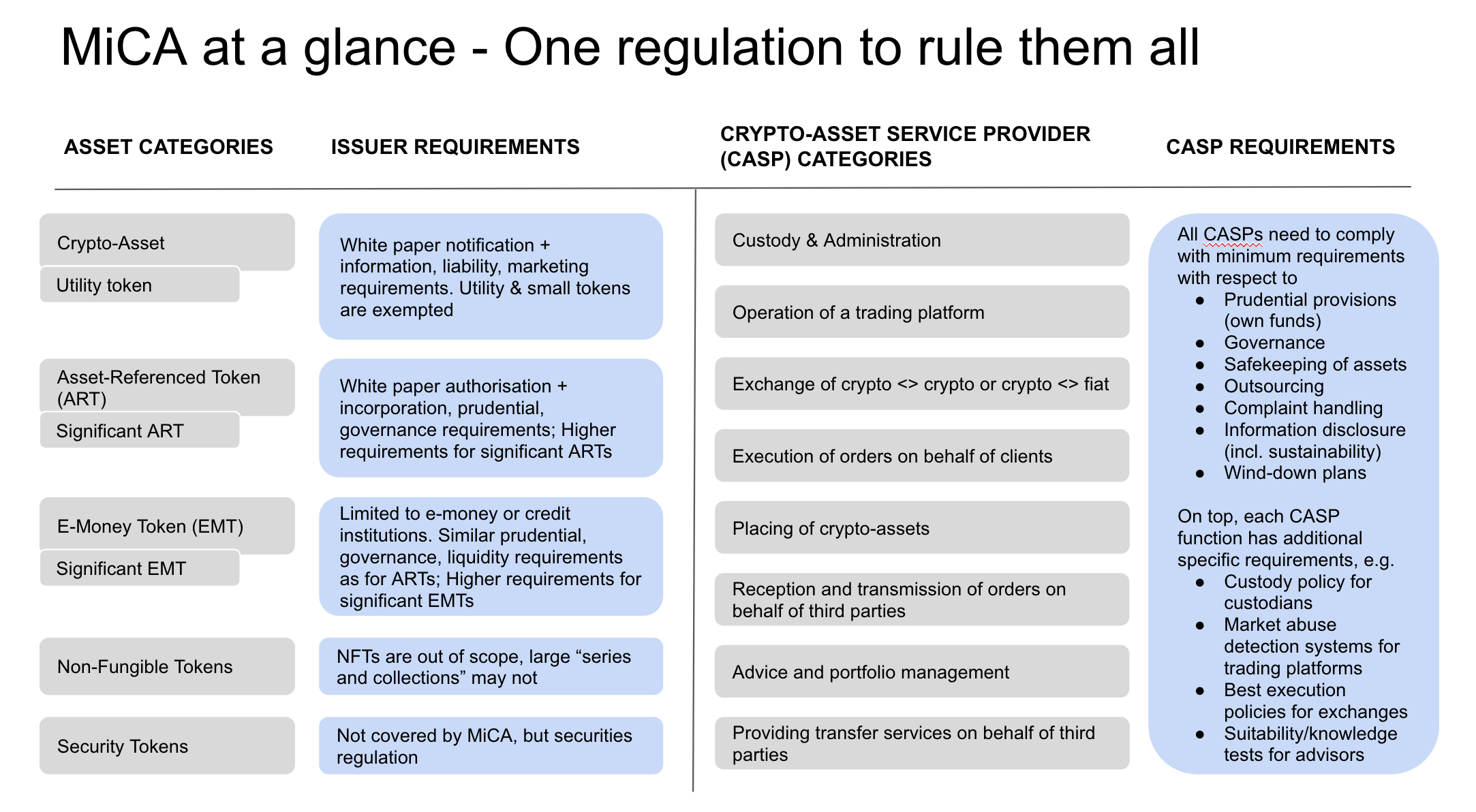

The Markets in Crypto-Assets (MiCA) regulation is a European Union framework to govern crypto-assets, aiming to protect consumers and ensure financial stability. The Travel Rule, part of MiCA, requires crypto service providers to share sender and recipient information for transactions, similar to traditional banking, to prevent money laundering and terrorist financing.

How Do These Affect Withdrawals and Deposits?

For withdrawals, users may need to:

-

Verify ownership of self-hosted wallets, especially for transactions over €1,000, often through a one-time process like signing a message with the wallet’s private key.

-

Provide details about the recipient if withdrawing to another platform, such as specifying the exchange for their own account or recipient information for others.

For deposits, platforms might:

-

Automatically process deposits from recognized platforms but require verification for new self-hosted wallets.

-

Ask users to confirm sender details if the deposit comes from an unrecognized hosted wallet.

These changes ensure compliance with EU regulations, potentially enhancing security but possibly raising privacy concerns for users.

Survey Note: Detailed Analysis of MiCA and Travel Rule Requirements for Crypto Withdrawals and Deposits

The European Union’s Markets in Crypto-Assets (MiCA) regulation, adopted in May 2023 and fully applicable by December 2024, marks a significant milestone in regulating the cryptocurrency sector. A critical component, the Travel Rule, extends anti-money laundering (AML) and counter-terrorist financing (CTF) measures to crypto transactions, mandating Crypto-Asset Service Providers (CASPs) to collect and share specific information. This survey note explores the implications for crypto withdrawals and deposits, detailing the requirements and their impact on users, based on current regulatory texts and platform implementations.

Background on MiCA and the Travel Rule

MiCA provides a harmonized framework for crypto-assets, categorizing them into utility tokens, asset-referenced tokens (ARTs), and e-money tokens (EMTs). It aims to protect consumers, ensure market integrity, and foster innovation, with specific rules for issuers and service providers. The Travel Rule, implemented through Regulation (EU) 2023/1113, aligns with FATF Recommendation 16, requiring CASPs to accompany transfers with originator and beneficiary information, regardless of transaction amount, to enhance transparency and traceability.

The regulation applies to transfers involving at least one EU-registered CASP, excluding person-to-person transfers without CASP involvement. For transactions over €1,000 involving self-hosted wallets, additional verification is required, reflecting heightened risk assessments.

Detailed Requirements for Withdrawals

When users initiate withdrawals, platforms must comply with the Travel Rule, which involves:

-

To Self-Hosted (Unhosted) Wallets:

-

Users must verify ownership to ensure the wallet belongs to them, often through cryptographic methods like signing a message with the private key. This is a one-time process, as seen in implementations like Knaken, where once verified, the wallet is whitelisted for future transactions (Knaken – The Travel Rule: What It Means for Your Crypto Transactions).

-

For transactions exceeding €1,000, enhanced due diligence may apply, as per Article 19a(1) of Directive (EU) 2015/849, requiring identity verification and additional monitoring.

-

-

To Hosted Wallets (Other Platforms):

-

If withdrawing to the user’s own account on another platform, they need to indicate the exchange or broker, facilitating information sharing between CASPs.

-

If the recipient is another person, users may need to provide recipient details, such as name and account number, to comply with beneficiary information requirements under Article 15 of Regulation (EU) 2023/1113.

-

Platforms like Binance and Kraken have been noted to implement such measures, with users reporting needs to whitelist addresses and provide recipient information, especially post-December 2024 (r/Bitcoin on Reddit: New EU regulation on withdrawal – Kraken).

Detailed Requirements for Deposits

For deposits, the platform acts as the CASP of the beneficiary, requiring:

-

From Self-Hosted (Unhosted) Wallets:

-

If the wallet is already verified, the deposit proceeds normally, as seen in Knaken’s process. For new wallets, a simple ownership verification is required, similar to withdrawals, ensuring compliance with originator information under Article 14 (Knaken – The Travel Rule: What It Means for Your Crypto Transactions).

-

For amounts over €1,000, platforms may apply enhanced monitoring, assessing risks related to the client’s wallet.

-

-

From Hosted Wallets (Other Platforms):

-

If the sending platform is recognized, the deposit may be processed automatically, with information shared via Travel Rule protocols like IVMS101. If not, users might need to confirm wallet details and sender identity, ensuring the CASP verifies accuracy before making assets available, per Article 40 of Directive (EU) 2015/849.

-

User reports, such as on KrakenSupport Reddit, indicate funds may be placed on hold for deposits, requiring verification, especially post-December 30, 2024, due to the EU Travel Rule (r/KrakenSupport on Reddit: Understanding the EU Travel Rule: Why Your Funds May Be on Hold and How to Resolve It Quickly).

Implementation Challenges and User Impact

Platforms are adopting various technologies, such as the Global Travel Rule Alliance (GTR) for Binance and Travel Rule Universal Solution Technology (TRUST) for Coinbase, to facilitate compliance (Binance Joins the Global Travel Rule Alliance to Advance Interoperable Compliance and Strengthen Security | Binance Blog, Travel Rule Universal Solution Technology). These solutions ensure secure data sharing, but users may face:

-

Privacy Concerns: The need to link KYC details to wallet addresses, especially for self-hosted wallets, has raised concerns, as seen in Reddit discussions, with users feeling intrusive measures may compromise anonymity (r/Bitcoin on Reddit: New EU regulation on withdrawal – Kraken).

-

Verification Processes: One-time ownership verification for self-hosted wallets adds a step, potentially delaying transactions, though platforms like Knaken aim to streamline this (Knaken – The Travel Rule: What It Means for Your Crypto Transactions).

-

Operational Adjustments: Users must stay informed via platform announcements, such as Kraken’s emails about whitelisting, to avoid disruptions (r/Kraken on Reddit: Travel rule for EU citizens?).

Comparative Table of Requirements

|

Transaction Type

|

Self-Hosted Wallet

|

Hosted Wallet

|

|---|---|---|

|

Withdrawal

|

Verify ownership (one-time, e.g., sign message); Enhanced due diligence for >€1,000

|

Specify platform for own account; Provide recipient details for others

|

|

Deposit

|

Verify new wallets; Normal for verified wallets; Enhanced monitoring for >€1,000

|

Automatic if recognized; Confirm details if unrecognized

|

Regulatory and Future Considerations

The European Banking Authority (EBA) is set to issue guidelines by December 30, 2024, on measures for self-hosted addresses, per Article 19a(2) of Regulation (EU) 2023/1113, potentially affecting future requirements. The Commission will assess additional measures by July 1, 2026, focusing on self-hosted address risks, per Article 37(2), which could lead to further changes.

Users are advised to contact platform support, such as Knaken at support@knaken.eu, for assistance, ensuring compliance while navigating these regulatory shifts (Knaken – The Travel Rule: What It Means for Your Crypto Transactions).

This detailed analysis underscores the balance between regulatory compliance and user experience, highlighting the evolving landscape of crypto transactions in the EU as of April 10, 2025.

Discover more from LEW.AM Asset Management

Subscribe to get the latest posts sent to your email.