-

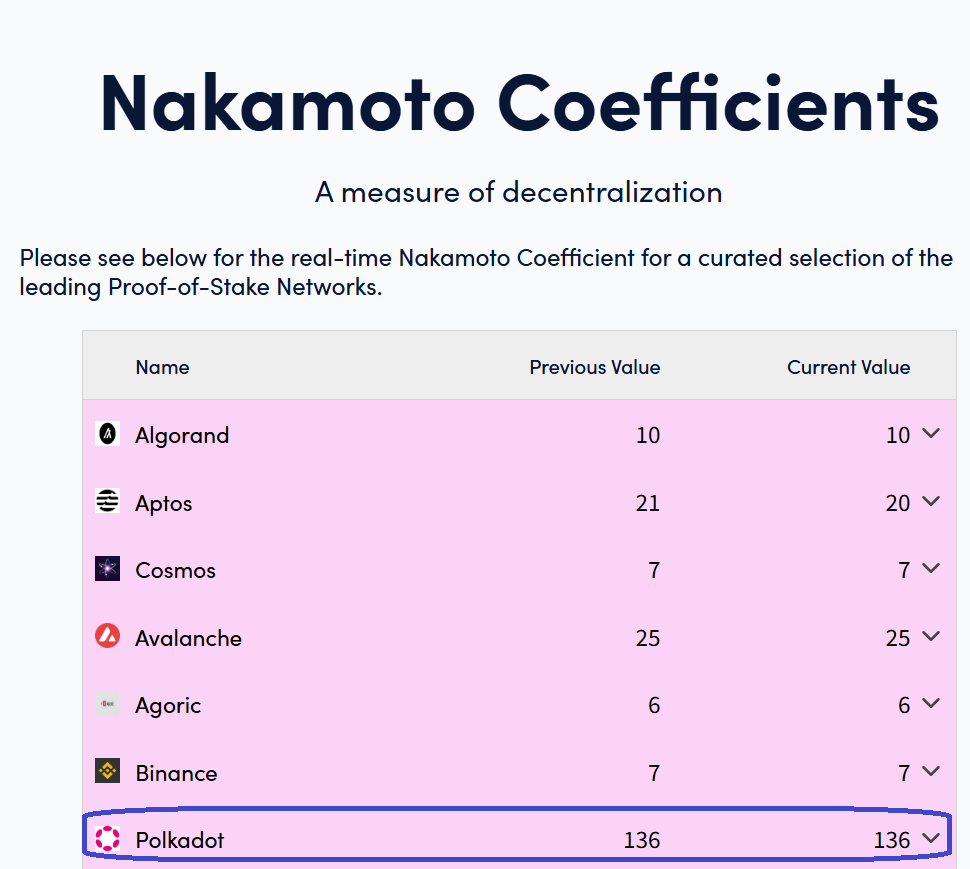

Polkadot’s Nakamoto Coefficient is around 149, indicating high decentralization.

-

It seems likely that Polkadot is more decentralized than most top blockchains, with Bitcoin at 3 and Ethereum at 2.

-

The evidence leans toward Polkadot’s design enhancing security, but exact comparisons vary by consensus type.

Polkadot’s Nakamoto Coefficient

Polkadot, a blockchain platform for interoperability, has a Nakamoto Coefficient of about 149 as of early 2025, based on statements from its co-founder. This means 149 independent validators would need to collude to control 33% of the staked tokens, suggesting strong decentralization.

Comparison with Top Blockchains

When compared to the top 20 blockchains by market cap, Polkadot stands out. For instance, Bitcoin’s coefficient is 3, meaning just three mining pools control over 50% of its hashrate, while Ethereum’s is 2, with two entities controlling over 33% of staked ETH. Other PoS blockchains like Solana (18) and Avalanche (24) also show lower figures, indicating less decentralization than Polkadot.

Unexpected Detail: Variability in Consensus

An interesting aspect is that not all top blockchains fit the Nakamoto Coefficient model, like Tether or XRP, due to different consensus mechanisms, which adds complexity to comparisons but highlights Polkadot’s unique position among PoS networks.

Survey Note: Detailed Analysis of Polkadot’s Nakamoto Coefficient and Comparison with Top Blockchains

Introduction to the Nakamoto Coefficient

The Nakamoto Coefficient is a metric introduced in 2017 by Balaji S. Srinivasan, former CTO of Coinbase, to quantify the decentralization of blockchain networks. It represents the minimum number of independent entities—such as validators, miners, or nodes—that must collude to disrupt the network’s consensus mechanism. For Proof-of-Work (PoW) blockchains, it is the number of mining pools controlling more than 50% of the hashrate, while for Proof-of-Stake (PoS) blockchains, it is typically the number of entities controlling more than 33% of the staked tokens, as this threshold can enable certain attacks in many PoS systems.

Decentralization is crucial for blockchain security, resilience, and trustlessness, ensuring no single entity can dominate the network. A higher Nakamoto Coefficient indicates greater decentralization, making the network more resistant to attacks like 51% attacks or governance manipulation. This article explores Polkadot’s Nakamoto Coefficient and compares it to the top 20 blockchains by market cap as of April 2025, providing a comprehensive analysis of their decentralization levels.

Polkadot’s Nakamoto Coefficient

Polkadot is a Layer-0 protocol designed for connecting and securing multiple blockchains, enabling interoperability. It uses a nominated Proof-of-Stake (NPoS) consensus mechanism, where token holders nominate validators based on their stake. According to an X post by Gavin Wood, Polkadot’s co-founder, in February 2025, the Nakamoto Coefficient for Polkadot is 149 (Gavin Wood on Polkadot’s NC). This means that at least 149 independent validators would need to collude to control 33% of the staked DOT tokens, suggesting a high level of decentralization. This figure reflects Polkadot’s design, which aims to distribute control widely among participants, enhancing network security and resilience.

Methodology for Comparison

To compare Polkadot with the top 20 blockchains, we first identified the ranking based on market capitalization as of April 9, 2025, using data from Slickcharts cryptocurrency market cap. The top 20 include Bitcoin, Ethereum, Tether, XRP, BNB, Solana, USDC, Dogecoin, TRON, Cardano, UNUS SED LEO, Chainlink, Toncoin, Avalanche, Stellar, Sui, Hedera, Shiba Inu, MANTRA, and Bitcoin Cash. However, not all are blockchains with their own consensus mechanisms; stablecoins like Tether and USDC, and tokens like UNUS SED LEO and Chainlink, are excluded from NC calculations. For the remaining, we gathered NC data from various sources, focusing on PoW and PoS blockchains where applicable, and noted that some, like XRP and Stellar, use different consensus models (e.g., XRP Ledger Consensus Protocol, federated Byzantine agreement), which may require alternative metrics.

Data Collection and Calculations

For PoW blockchains, we calculated the NC based on mining pool hashrate distribution. For PoS blockchains, we used reported NC values from sources like CCN on Nakamoto Coefficients and other articles, acknowledging potential updates since November 2024. Specific calculations included:

-

Bitcoin (BTC): Using Hashrate Index data, the top three pools (Foundry USA at 30.11%, AntPool at 19.52%, ViaBTC at 13.57%) control 63.2% of the hashrate, yielding an NC of 3.

-

Ethereum (ETH): From beaconcha.in pools, Lido and other large pools suggest an NC of 2, as the top two entities control over 33% of staked ETH, consistent with CCN data.

-

Cardano (ADA): An article from CExplorer on Cardano NC states the Minimum Attack Vector (MAV) is 22 for controlling 51% of stake, likely similar for 33%, given its design with many stake pools.

-

Other PoS blockchains’ NCs were sourced from CCN article, including Solana (18), Avalanche (24), Binance Smart Chain (7), Cosmos (7), Polygon (4), Near (11), and Thorchain (33).

For blockchains like XRP, Stellar, and Hedera, NC calculations were not pursued due to different consensus mechanisms, but noted for completeness.

Comparative Analysis

Below is a table summarizing the Nakamoto Coefficients for Polkadot and relevant top blockchains:

|

Blockchain

|

Consensus

|

Nakamoto Coefficient

|

Notes

|

|---|---|---|---|

|

Polkadot (DOT)

|

PoS (NPoS)

|

149

|

High decentralization, 149 validators for 33% stake, per Gavin Wood.

|

|

Bitcoin (BTC)

|

PoW

|

3

|

Top 3 pools control >50% hashrate.

|

|

Ethereum (ETH)

|

PoS

|

2

|

Top 2 entities control >33% stake, high centralization risk.

|

|

Cardano (ADA)

|

PoS

|

22

|

22 entities for 51% stake, likely high for 33%, many stake pools.

|

|

Solana (SOL)

|

PoS

|

18

|

18 validators for 33% stake, per CCN data.

|

|

Avalanche (AVAX)

|

PoS

|

24

|

24 validators for 33% stake, per CCN data.

|

|

BNB (BNB)

|

PoSA

|

7

|

7 validators for 33% stake, per CCN data.

|

|

Cosmos (ATOM)

|

PoS

|

7

|

7 validators for 33% stake, per CCN data.

|

|

Polygon (MATIC)

|

PoS

|

4

|

4 validators for 33% stake, per CCN data.

|

|

Near (NEAR)

|

PoS

|

11

|

11 validators for 33% stake, per CCN data.

|

|

Thorchain (RUNE)

|

PoS

|

33

|

33 validators for 33% stake, per CCN data.

|

Polkadot’s NC of 149 is notably higher than all compared blockchains, indicating superior decentralization. Bitcoin and Ethereum, with NCs of 3 and 2 respectively, show significant centralization risks, particularly Ethereum with its reliance on large staking pools like Lido. Cardano, Solana, and Avalanche, with NCs ranging from 18 to 24, are more decentralized but still lag behind Polkadot. Thorchain, at 33, is closer but still lower, while others like Polygon (4) and Cosmos (7) show lower decentralization.

Discussion and Limitations

Polkadot’s high NC reflects its design to distribute control widely, enhancing security against collusion. However, the Nakamoto Coefficient is just one metric and does not capture all aspects of decentralization, such as node distribution, client diversity, or governance structures. For instance, Ethereum’s low NC (2) highlights centralization risks, but efforts like the Pectra upgrade in 2025 aim to improve this. Similarly, Cardano’s NC of 22 suggests good distribution, but its stake pool saturation and operator incentives affect decentralization dynamics.

For blockchains not analyzed (e.g., XRP, Stellar), alternative metrics may be needed due to different consensus mechanisms, which adds complexity to comparisons. Market cap rankings show Polkadot at #22 as of April 6, 2025, per CoinMarketCap, not in the top 20, but its NC comparison remains relevant for its prominence in PoS ecosystems.

Conclusion

Polkadot’s Nakamoto Coefficient of 149 positions it as highly decentralized compared to top blockchains, with Bitcoin at 3, Ethereum at 2, and others like Solana (18) and Avalanche (24) also lower. This high decentralization enhances Polkadot’s security and resilience, making it a leader in the PoS space. As blockchain technology evolves, maintaining such decentralization will be crucial for network integrity and adoption, with Polkadot setting a benchmark for others to follow.

Discover more from LEW.AM Asset Management

Subscribe to get the latest posts sent to your email.